43+ how much of your income should be mortgage

Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Ad Updated FHA Loan Requirements for 2023.

How Much Of My Income Should Go Towards A Mortgage Payment

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

. Why Rent When You Could Own. Ad Get an idea of your estimated payments or loan possibilities. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income.

Web Your front-end or household ratio would be 1800 7000 026 or 26. To get the back-end ratio add up your other debts along with your housing expenses. Ad 10 Best House Loan Lenders Compared Reviewed.

Generally speaking most prospective homeowners can afford to finance a property that costs between two and two-and-a-half. Web How much mortgage can you afford. With a Low Down Payment Option You Could Buy Your Own Home.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. John in the above example makes. Get Instantly Matched With Your Ideal Mortgage Lender.

Web Your income exceeds 1100 and includes more than 350 of unearned income such as interest or dividends. Web How Much Mortgage Can I Afford. Web The 28 rule refers to your mortgage-to-income ratio.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. With a Low Down Payment Option You Could Buy Your Own Home. Keep in mind that this exemption only applies to.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web What percentage of income do I need for a mortgage. For the 2022-2023 tax year the standard deduction.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Lock Your Rate Today. Lock Your Rate Today.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ad Calculate Your Payment with 0 Down.

Even with this 43 threshold lenders generally require a more. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Thats a mortgage between 120000 and. Web Most home loans require a down payment of at least 3. Web 2 days agoThe standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed.

Check Your Official Eligibility Today. Get Instantly Matched With Your Ideal Mortgage Lender. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Try our mortgage calculator. Comparisons Trusted by 55000000. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Veterans Use This Powerful VA Loan Benefit For Your Next Home. 1000 Max home expenses.

43 043 x 5000 2150 Max debt payments. Ad Tired of Renting. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. Take the First Step Towards Your Dream Home See If You Qualify. Comparisons Trusted by 55000000.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Ad 10 Best House Loan Lenders Compared Reviewed.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you.

5464 Bryant Hill Road Ellicottville Ny 14731 Mls B1370278 Howard Hanna

How To Find Out If You Can Afford Your Dream Home

The Debt Collective Strikedebt Twitter

How Much House Can I Afford Insider Tips And Home Affordability Calculator

40 Sample Hardship Letters In Pdf Ms Word

How Much Home Can You Afford Advanced Topics

Courier News Vol 43 Num 11 By Edward Reagan Issuu

Expat Mortgages In The Netherlands Buy A House Hanno

Oregon Financial Services Businesses For Sale Bizbuysell

How Much House Can I Afford Forbes Advisor

Business Succession Planning And Exit Strategies For The Closely Held

Free 50 Employment Verification Samples In Pdf Ms Word

How Can Thailand Justify Spending 90 Million On The King S Funeral Quora

Budget Percentages What Percentage Of Your Income Should Go To

How Much Of My Income Should Go Towards A Mortgage Payment

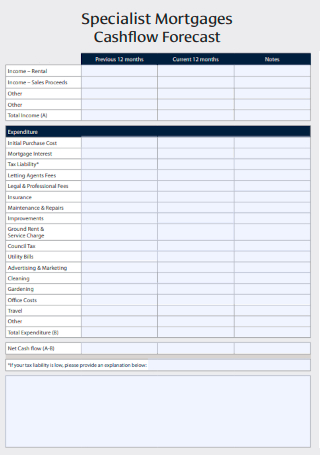

Sample Cash Flow Forecast 7 In Pdf

What Percentage Of Your Income Should Go To Mortgage Chase